39 advantage of zero coupon bonds

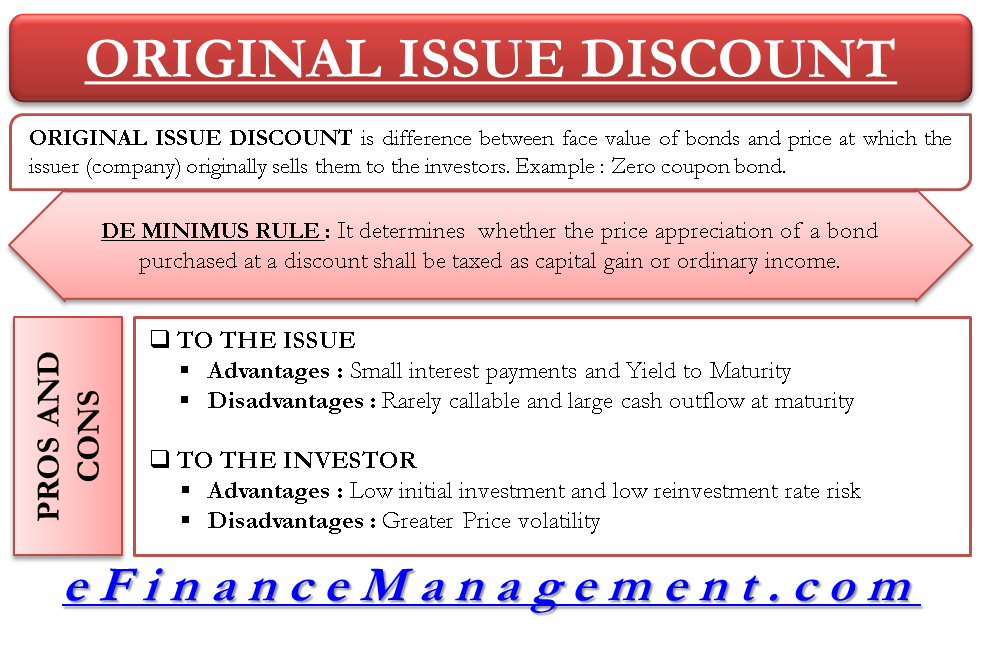

Are there any advantages to zero-coupon bonds from the issuers ... The most obvious advantage for a corporate issuer of zero-coupon bonds is the high demand for this type of security. These bonds are priced much lower than current coupon securities with the same ... The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Instead, you purchase the bond for a discount and then when it matures, you can get back the face value of the bond. This is a long-term type of investment that can provide nice yields. Here are some of the pros and cons of investing in zero-coupon bonds. Pros. One of the big advantages of zero coupon bonds is that they have higher interest ...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only.

Advantage of zero coupon bonds

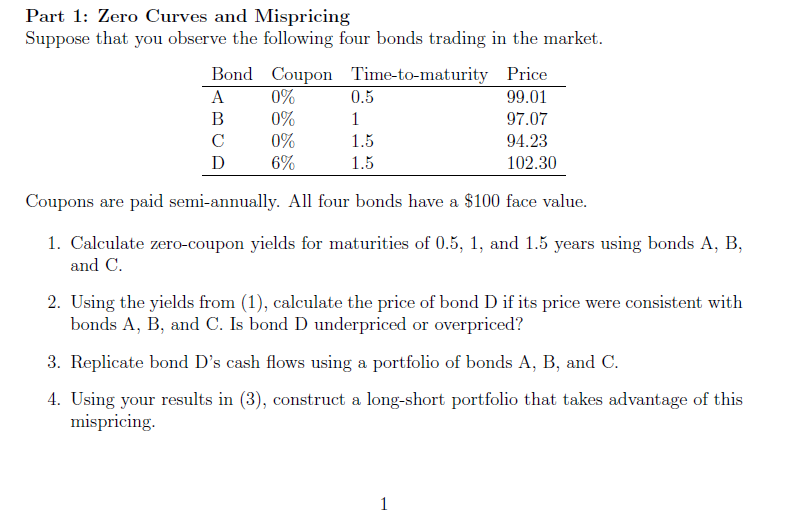

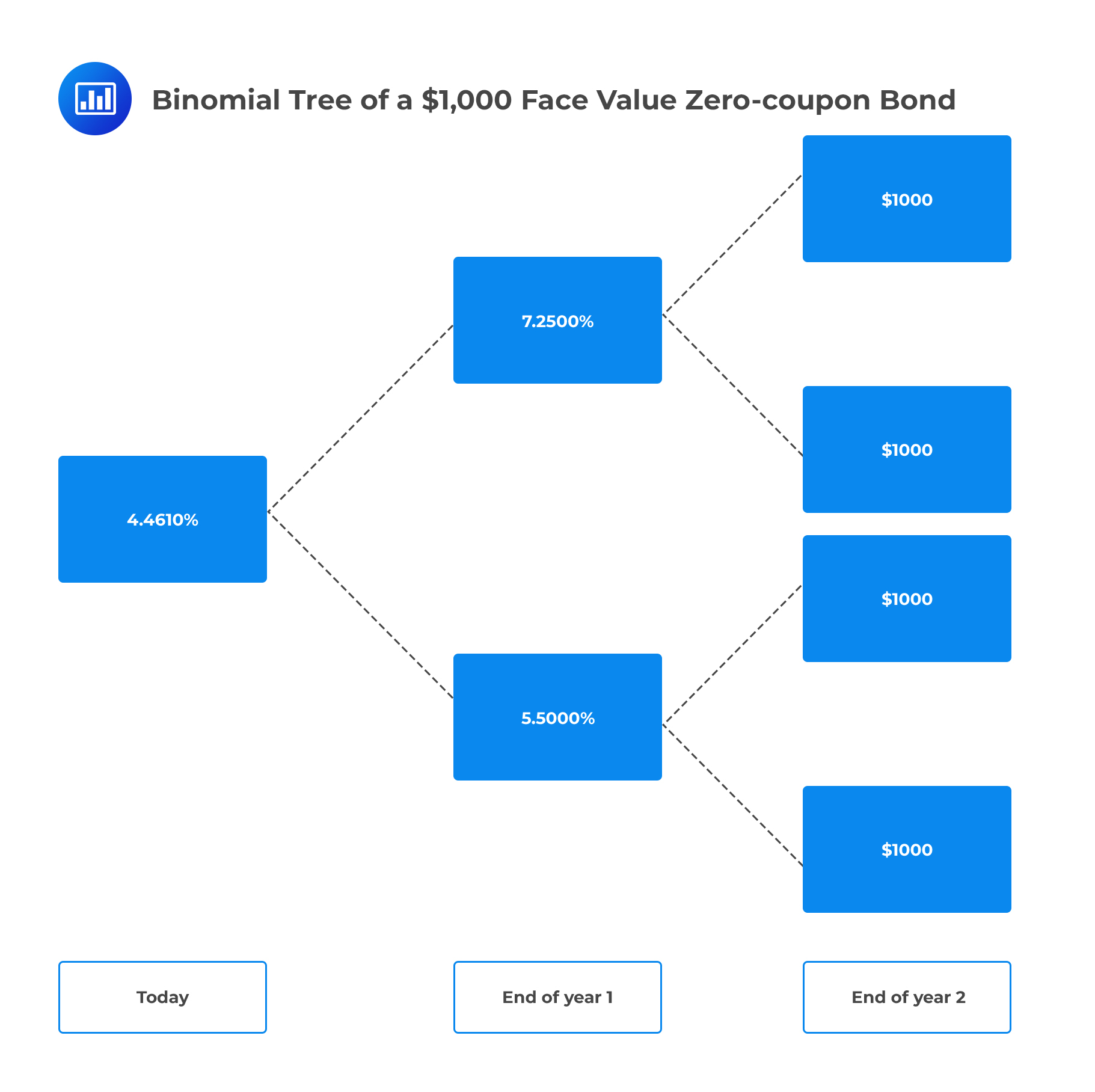

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds can work to your advantage, if used judiciously and in tandem with your investment objectives. Without any intermittent coupon payments, the calculation of yield to maturity of a zero-coupon bond is as follows: (Face value/ current market price) *(1/years to maturity) - 1; Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity. Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

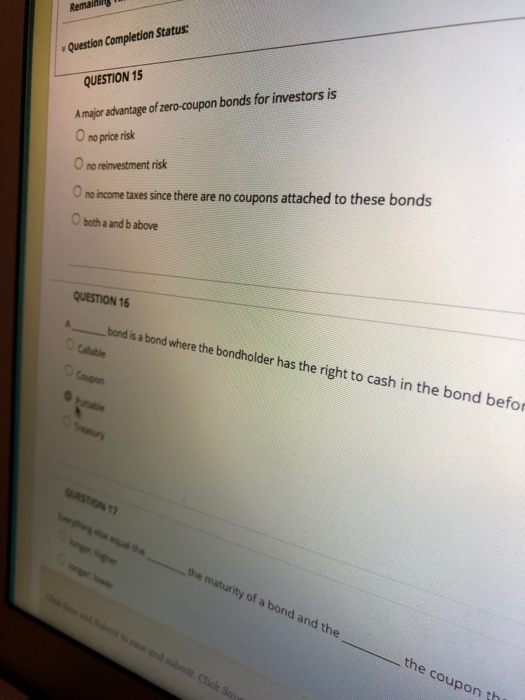

Advantage of zero coupon bonds. What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. What are the advantages and disadvantages of zero-coupon bond? Answer (1 of 8): Zero coupon bonds require you to report implied interest every year on "phantom income" which you do not get until the bond matures. This seems like a bad idea to me

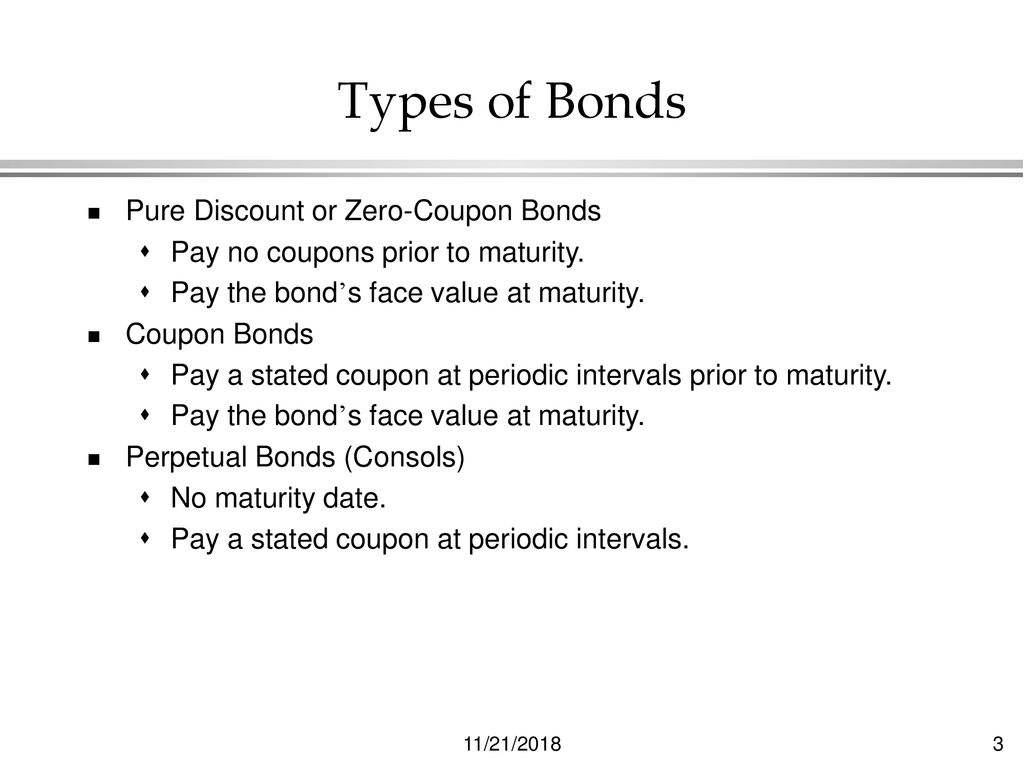

Advantages and Disadvantages of Bonds | Boundless Finance - Course Hero Zero coupon bonds: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. ... Advantages of Bonds Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is ... Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Julius Mansa. The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon ... Invest in Zero Coupon Bond at Yubi | Learn All About It The imputed interest added to the purchase price gives yield to maturity of the zero coupon bond, which the investor receives automatically in the future as a phantom income. The long time horizon of zero coupon bonds is a major advantage for investors. With long-term maturity dates, bond buyers do not need to worry about the short term. What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar Bonds with zero coupons are issued at a discount and redeemed at face value. On such bonds, no interest is paid at regular intervals before maturity. The price at which Zero Coupon Bonds are offered for purchase is substantially lower than the bond's face value. Thus, offering an investor an advantage to begin their investment at low valuations.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... What Is a Zero-Coupon Bond? - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Advantages of Zero-Coupon Bonds. From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case ...

What are Zero Coupon Bonds? | Features, Advantages, Disadvatages As discussed earlier, the return for investors in the case of a zero coupon bond is equal to the difference between its issue price and redemption price. Maturity Period. ZCBs are issued for a minimum period of 10 years. Advantages of Zero Coupon Bonds. Let us look at some of the reasons why an investor should invest in ZCBs. Long-Term in Nature

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds. Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time ...

Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds can work to your advantage, if used judiciously and in tandem with your investment objectives. Without any intermittent coupon payments, the calculation of yield to maturity of a zero-coupon bond is as follows: (Face value/ current market price) *(1/years to maturity) - 1;

:max_bytes(150000):strip_icc()/Terms-series-I-bond-4189218-FINAL-269f8fb6ebbd41b9989f66507b4bfa9d.png)

Post a Comment for "39 advantage of zero coupon bonds"