38 coupon rate of bond calculator

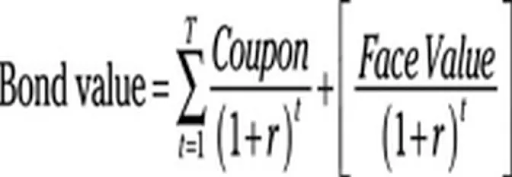

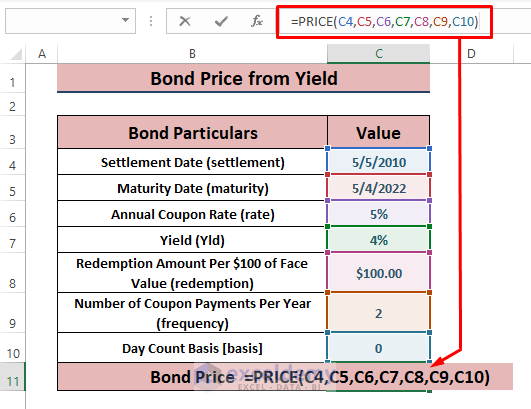

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Financial Calculators Bond Calculator Instruction. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field. Enter amount in negative value. Face Value Field - The Face Value or Principal of the bond is calculated or ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Coupon rate of bond calculator

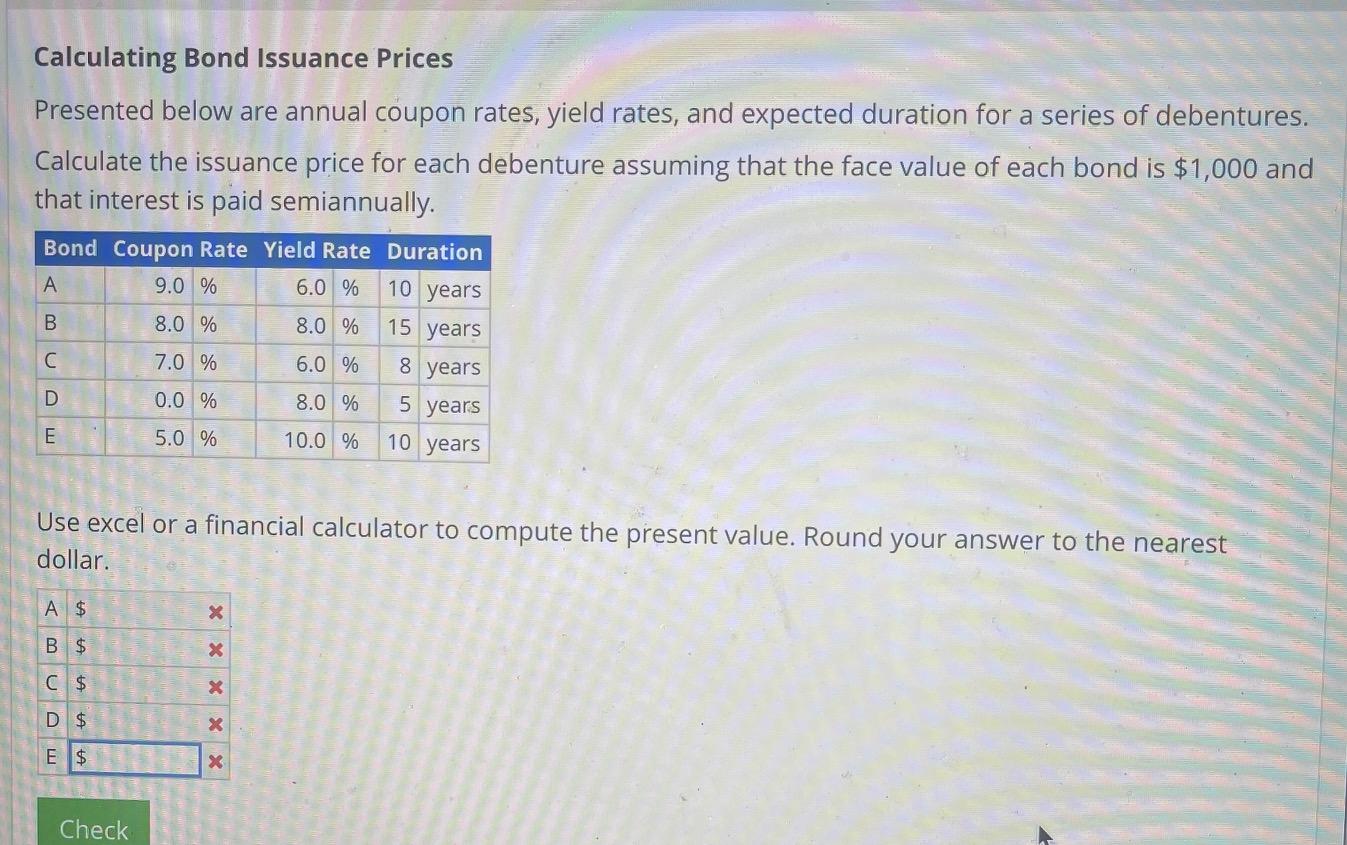

How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

Coupon rate of bond calculator. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Bond Yield to Maturity (YTM) Calculator - DQYDJ We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)? Coupon Payment Calculator If you want to calculate the annual coupon payment for a bond, all you have to do is multiply the bond's face value by its annual coupon rate. That means if you have a bond with a face value of $1000 and an annual coupon rate of 10%, then the annual coupon payment is 10% of $1000, which is $100. How to find the coupon payment?

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Coupon Rate Calculator | Solution Step by Step 🥇 Show calculator The coupon rate is the yield that a bond pays annually. The coupon rate is calculated as the sum of all periodic interest payments made on a bond divided by the face value of that bond. The coupon rate will typically be lower than the stated interest rate, which is also referred to as a nominal interest rate or nominal yield. Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Bond Yield Calculator | Calculate Bond Returns Determine the annual coupon rate and the coupon frequency coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Post a Comment for "38 coupon rate of bond calculator"