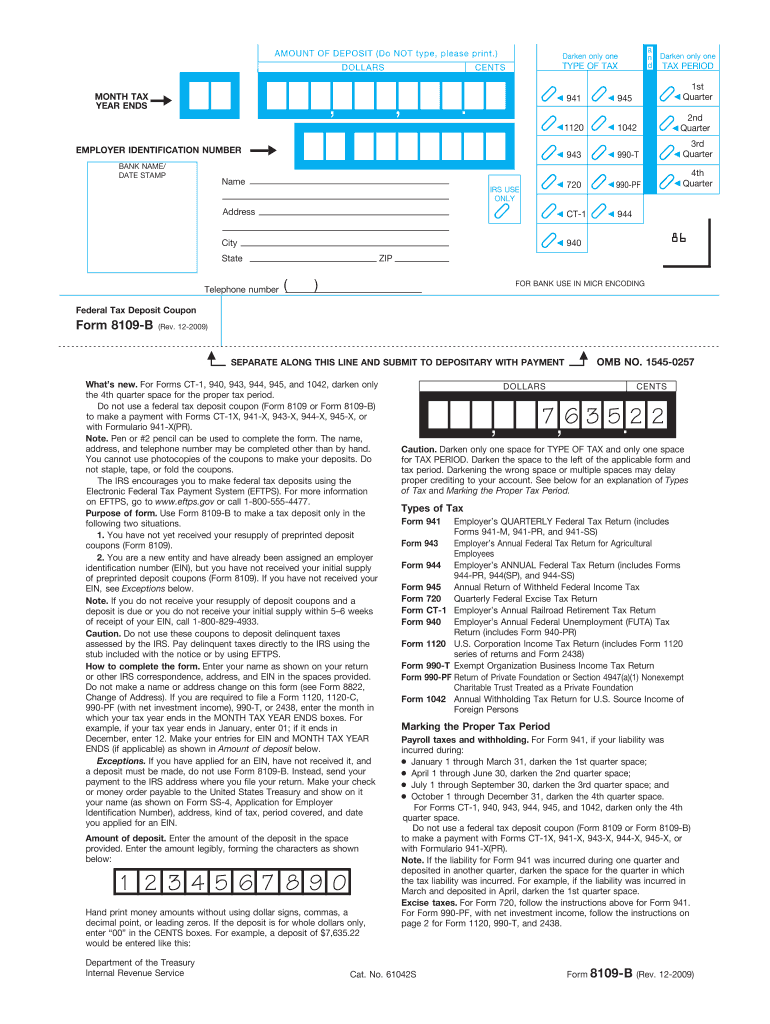

43 payment coupon for irs

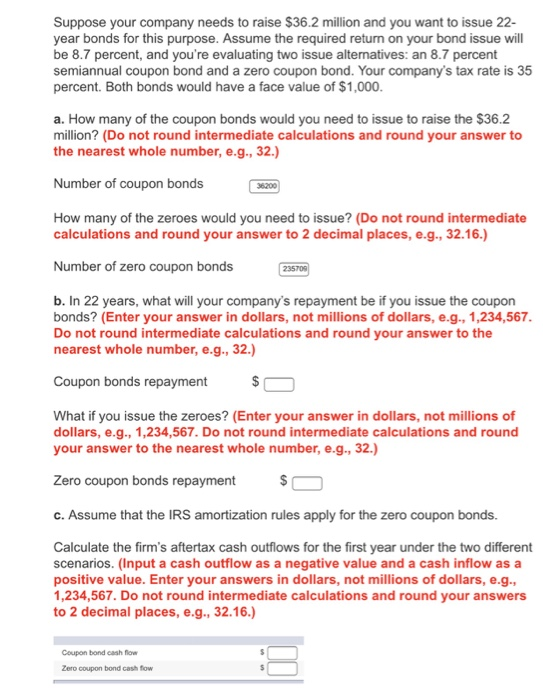

Irs estimated tax payment online near Hoa Binh Web04.01.2021 · Use a paper coupon, form 200-ES. To download and print a coupon, see our forms page. To order coupons, send e. ... Irs Estimated Tax Payment Online - USlegalForms© Official Site. . Download or Email IRS 1040-PR & More Fillable Forms, Register and Subscribe Now! USlegalForms allows users to Edit, … › ProductInfo › Payment-BooksPayment Coupon Books, Payment Books - Bank-A-Count.com Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom inserts, coupon formats, and more! All Bank-A-Count products are backed by an outstanding customer service team. Payment books feature: Affordable, competitive pricing

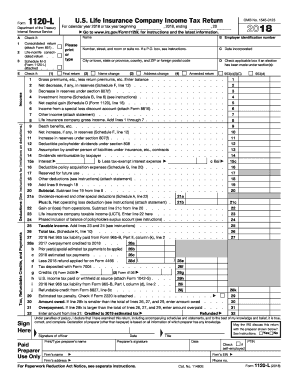

› pub › irs-pdf2021 Form 1040-V - IRS tax forms Form 1040-V (2021) Page . 2. IF you live in . . . THEN use this address to send in your payment . . . Alabama, Florida, Georgia, Louisiana, Mississippi, North

Payment coupon for irs

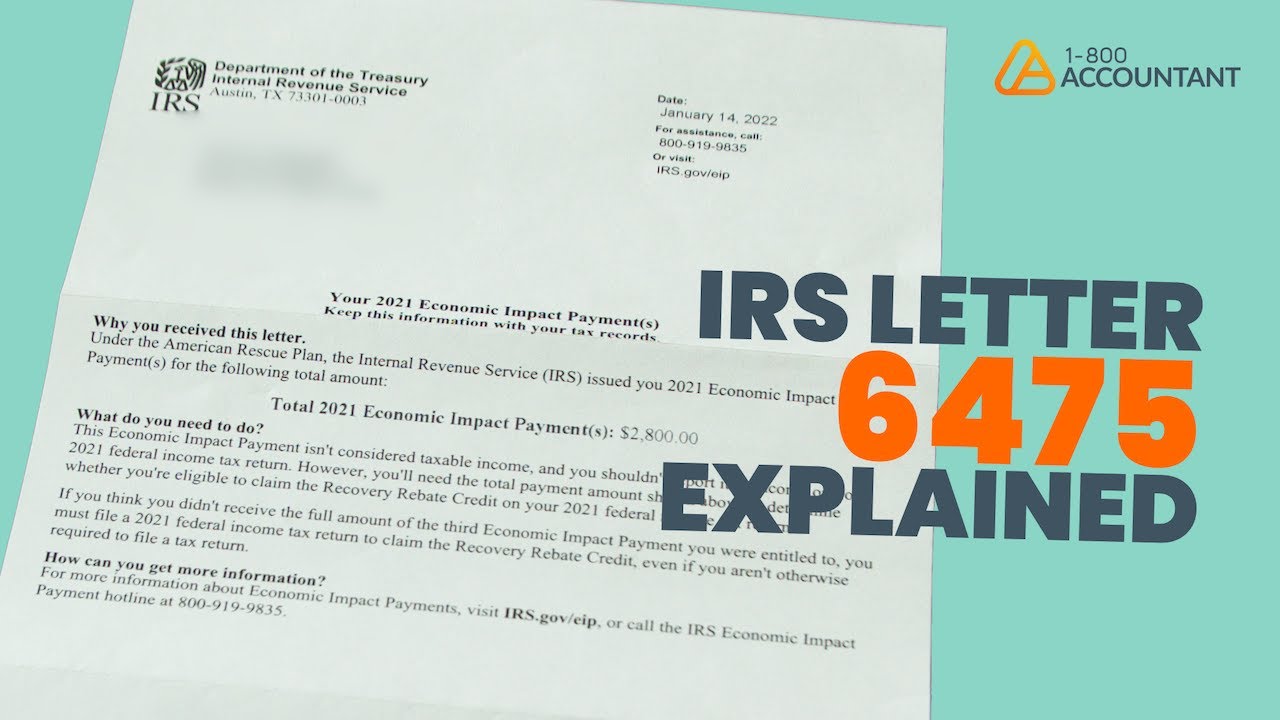

Confirm the IRS Received Your Payment | H&R Block WebIf two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can: › form-1040-v-4782902Form 1040-V: Payment Voucher Definition - Investopedia Jan 29, 2022 · Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. The ... › payPayments | Internal Revenue Service - IRS tax forms Sep 21, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Payment coupon for irs. 2022 Form 1040-ES - IRS tax forms Web1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the Four Things You Should Know Before Calling the IRS | H&R Block WebYou want to know the status of any IRS action (like a penalty abatement request, a payment correction, etc.) You want to make sure the IRS received your payment. You lost or never received your Form W-2 and/or Form 1099-R – or you got an incorrect one. › tax-center › irsFour Things You Should Know Before Calling the IRS You want to know the status of any IRS action (like a penalty abatement request, a payment correction, etc.) You want to make sure the IRS received your payment. You lost or never received your Form W-2 and/or Form 1099-R – or you got an incorrect one. About Form 1040-V, Payment Voucher - IRS tax forms Web26.08.2022 · Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

› tax-center › irsConfirm the IRS Received Your Payment | H&R Block If two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can: › how-to-pay-the-irs-31931197 Ways To Send Payments to the IRS - The Balance Mar 30, 2022 · You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 tax returns. Payment Coupon Books, Payment Books - Bank-A-Count.com WebIRS Address Stamps Seasonal Stamps New Ink Refills. Envelopes; Letters; Statements Payment Coupon Books For Assessments, Loans, And Fee Payments. Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom … Form 1040-V: Payment Voucher Definition - Investopedia Web29.01.2022 · Form 1040-V: Payment Voucher is a payment voucher that you send to the IRS along with your tax return if you make a payment with a check or money order.

7 Ways To Send Payments to the IRS - The Balance Web30.03.2022 · If You Need an Extension of Time to File . Some taxpayers might find that they can't make the tax filing date. You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, … › payPayments | Internal Revenue Service - IRS tax forms Sep 21, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. › form-1040-v-4782902Form 1040-V: Payment Voucher Definition - Investopedia Jan 29, 2022 · Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. The ... Confirm the IRS Received Your Payment | H&R Block WebIf two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can:

/1040-V-df038816cc244b248641f447493a030d.jpg)

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "43 payment coupon for irs"