40 yield to maturity for zero coupon bond

Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact yield to maturity formula are inside. ... Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ...

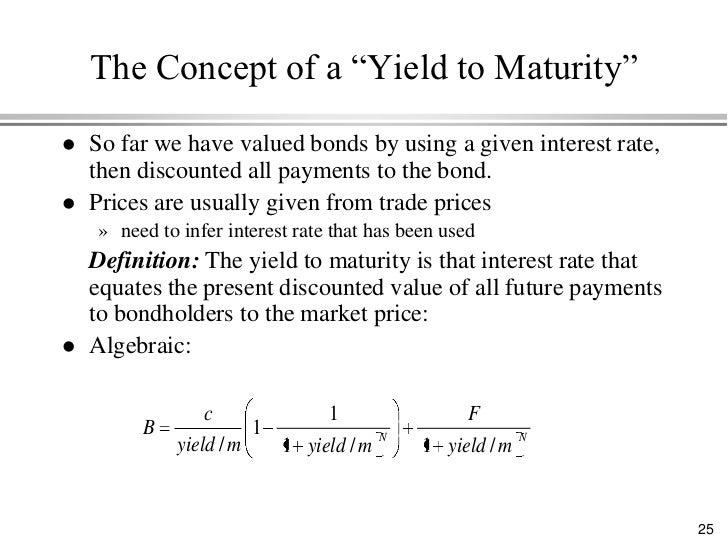

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an ...

Yield to maturity for zero coupon bond

Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed. Zero-Coupon Bond: Formula and Calculator [Excel Template] Zero-Coupon Bond Yield-to-Maturity (YTM) Formula — To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value ...

Yield to maturity for zero coupon bond. Yield Curves for Zero-Coupon Bonds - Bank of Canada Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as ... Yield to Maturity (YTM) - Investopedia Yield to maturity (YTM) is the total rate of return that will have been earned by a bond when it makes all interest payments and repays the original principal. Yield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate. The zero coupon bond formula is … Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. Bond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: Results: Current Yield: ... Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield. Compound Interest Present Value Return Rate / CAGR Annuity Pres. Val. of Annuity Bond Yield Mortgage

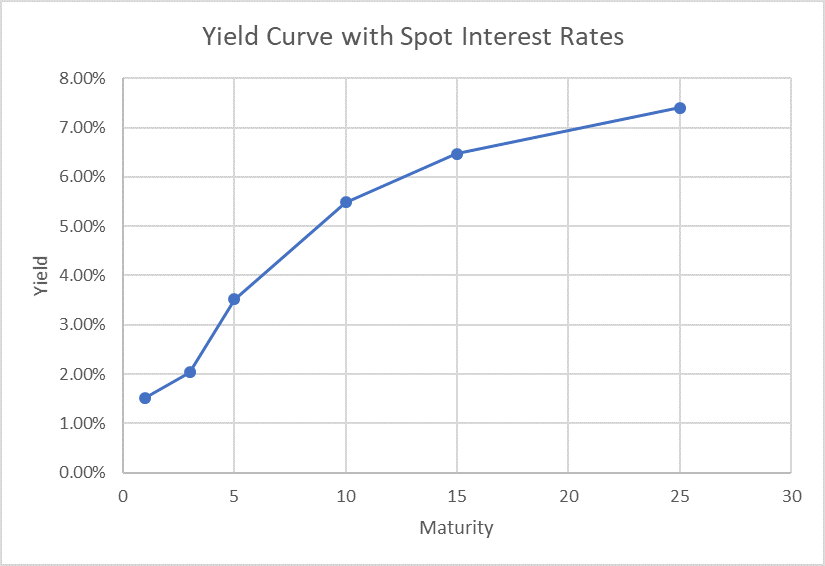

Bootstrapping | How to Construct a Zero Coupon Yield Curve in … Yield to Maturity: 3%: 3.50%: 4.50%: 6%: ... Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the ... Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Calculate Yield To Maturity Of A Zero Coupon Bond Without accounting for any interest payments, zero-coupon bonds always demonstrate yields to maturity equal to their normal rates of return. The yield to ...

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

Zero-Coupon Bond: Formula and Calculator [Excel Template] Zero-Coupon Bond Yield-to-Maturity (YTM) Formula — To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed.

Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ...

Post a Comment for "40 yield to maturity for zero coupon bond"