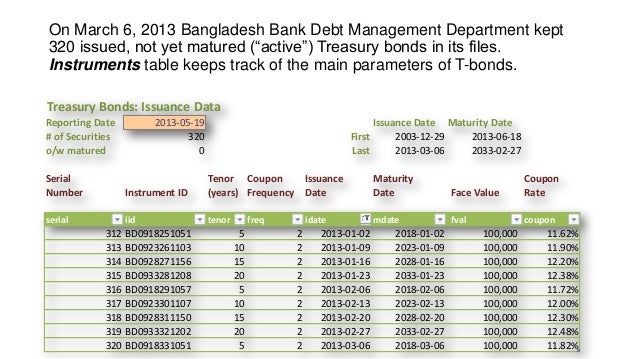

44 coupon rate treasury bond

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

20 Year Treasury Rate - YCharts Aug 24, 2022 · The 20 year treasury yield is included on the longer end of the yield curve. The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.50%, compared to 3.44% the previous market day and 1.84% last year.

Coupon rate treasury bond

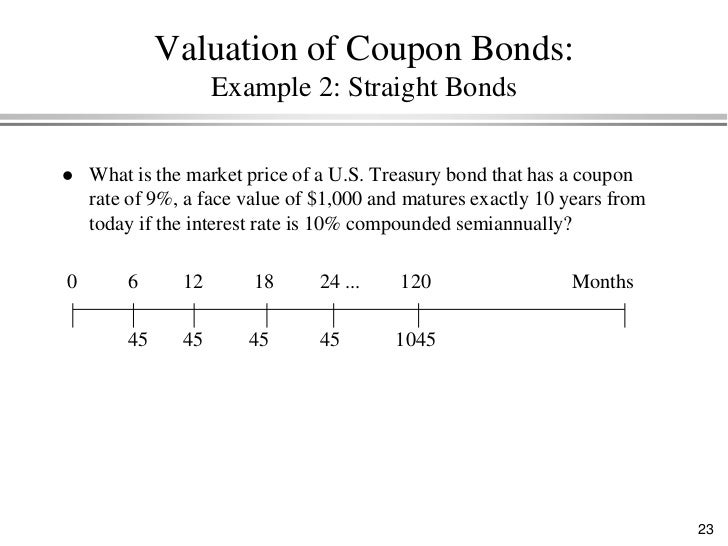

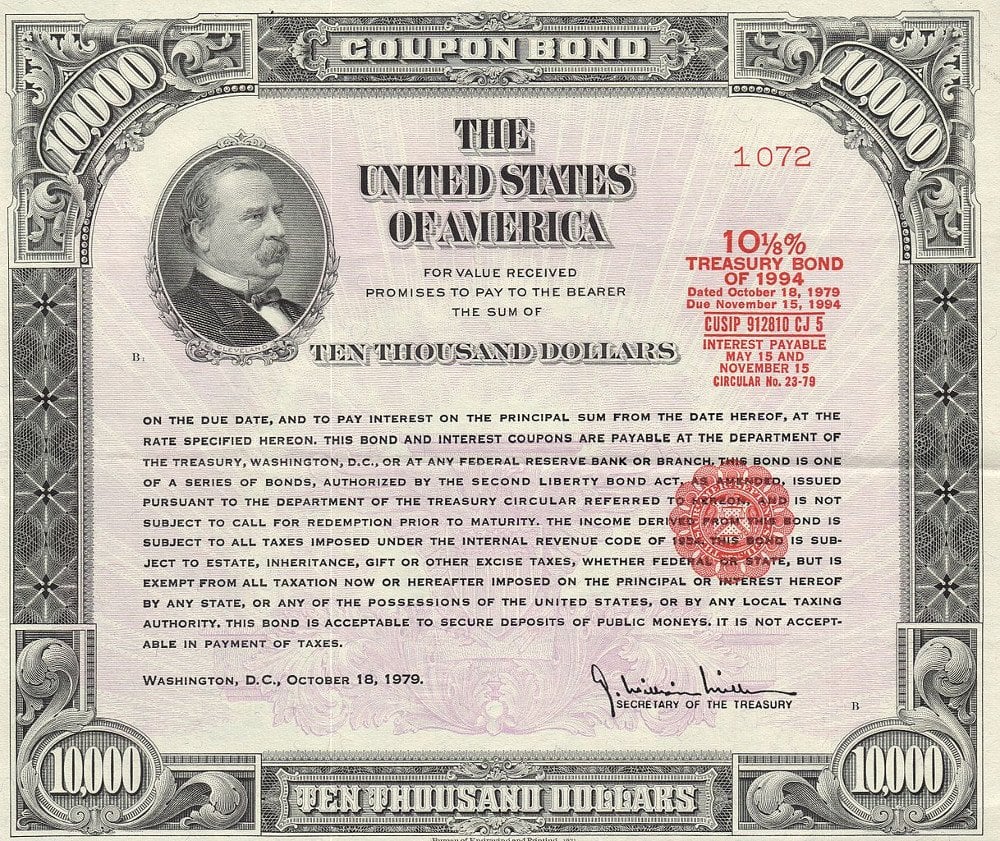

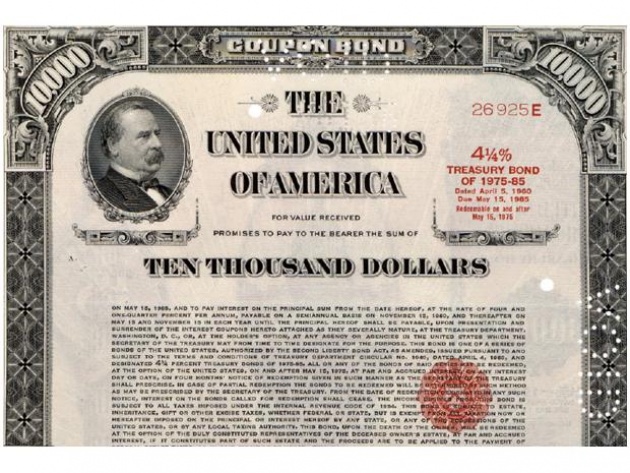

How Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ... U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Coupon rate treasury bond. Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis. U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. How Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ...

Post a Comment for "44 coupon rate treasury bond"